Welcome

We're Here to Serve YouOffice Hours are 8 AM to 5 PM Monday through Friday.

Our office re-opened to the public on May 3, 2021. We continue to provide a safe environment,

and we do our best to complete transactions as possible over the phone.

Click on the other tabs above to find specific information about valuation, taxation, and related public resources.

For more information, please call the Assessor's Office at 812-379-1505.

|

Ginny Whipple, AAS, CAII

Bartholomew County Assessor

812-379-1505

|

What's NewForm 11 - Notice of AssessmentTaxpayers should receive Form 11 - Notice of Assessment, which is mailed at the end of April.

This indicates the assessed value of real property owned by the taxpayer as of January 1.

The assessed value is an estimate intended to be within 10% of the value the property if it were

sold on the open market. Please review this carefully and notify our office of any discrepancy

or if you did not receive this form.

Filing Personal Property OnlineThe option is now available for taxpayers to file their personal property forms online. These were

traditionally submitted using Form 102, 103, and 104. These forms can still be obtained on our

Personal Property tab.

Submitting Sales Disclosure OnlineSales disclosures, used to report property exchange to the state, can now be completed online.

More information is available on the Sales Disclosure section.

|

Important DatesJanuary 1 - County-wide Property Valuation April 29 - Property Value Statements Issued May 15 - Personal Property Filing Due June 15 - Last Day for Assessment Appeal Public ResourcesAssociation of Indiana Counties (AIC) Crossroads Association of Realtors Department of Local Government Finance (DLGF) Indiana County Assessors Association (ICAA)

|

Real Property

Real PropertyBartholomew County assesses commercial and residential property in accordance with

Indiana state law. At right are important dates related to this process.

For more information, please call the Assessor’s office at 812-379-1505.

|

Important DatesJanuary 1 - County-wide Property Valuation April 29 - Property Value Statements Issued June 15 - Last Day for Assessment Appeal

|

Online Door HangerHave you found an orange door hanger at your property? This means we visited your

property, and we have additional questions which need your input. We ask that you call

our office, or you can e-mail us a completed property questionnaire.

|

|

Cyclical ReassessmentStatewide reassessment includes inspection of each property within a specific part of each county.

This is accomplished through the use of orthograpic imagery and field visits. Each year, 25% of the

county is assessed. After four years the entire county has been assessed. Below is a list of inspections

to be performed by township:

2024 Clay, Clifty, Haw Creek, and a portion of the city of Columbus

2025 Flat Rock, German, and a portion of the city of Columbus 2026 Harrison, Jackson, Ohio and a portion of the city of Columbus 2027 Rock Creek, Sand Creek, Wayne, and a portion of the city of Columbus Each field appraiser wears an ID badge and drives a county vehicle with the county seal on the doors.

If a taxpayer is uncertain about the identity of a representative, please contact the Bartholomew County

Assessor's Office at 812-379-1505 for verification.

Our field appraisers will attempt to make contact with taxpayers, identify themselves, and explain the

purpose for their visit. They will sometimes have to ask several questions to verify information about the

interior of the property and request permission to inspect the exterior.

If no one is home, personnel will proceed with their work, which includes an inspection of the front and

rear of the property. Photographs may also be taken during inspection. When the inspection is complete,

a door hanger may be left requesting the taxpayer contact our office to provide additional information.

|

Land and Property InformationPlease visit the Bartholomew County Geographical Information System (G.I.S) to search and view property inforamtion. |

Personal Property

Personal PropertyThe state of Indiana has launched its online Personal Property submission portal (PPOP-IN). This portal can

be used to complete the annual self-assessment traditionally filed using Form 104. Our office is still ready

and willing to help you file your personal property returns which are due by May 15th. In Indiana, personal

property is self-assessed. It is the responsibility of all Bartholomew County residents to file a return with

the County Assessor.

|

Important DatesMay 15 - Personal Property Filing Due

|

|

The staff at the assessor’s office can submit the forms electronically while the taxpayer is in the office. This

only takes a few minutes to pull up last year’s form, review it and resubmit. This will save taxpayers the time

and effort of filling out the forms themselves. If, however, a taxpayer prefers to complete the forms themselves,

the forms can be picked up at the assessor’s office located at 440 Third Street on the second floor of the

Government Office Building in Room 201. Forms can also can be obtained online at the DLGF website

|

Related Topics |

More on Personal PropertyCompleted personal property returns are due on May 15th of the assessment year. A penalty of twenty-five dollars ($25) applies for returns filed after May 15th. For returns not filed within thirty (30) days of the due date, an additional fee of twenty percent (20%) of the taxes payable will be assessed. Pursuant to Indiana Code 6-1.1-3-7 (b), a county assessor may grant an extension of not more than thirty (30) days to file the taxpayer’s return.

The taxpayer is responsible for reporting all tangible personal property used in their trade or business for the production of income or held as an investment. This includes among other things office equipment, office furniture and industrial and farm machinery.

Vehicles subject to excise tax are not considered personal property. Excise taxes are collected by the BMV at time of licensure. This includes cars, RVs, semis and farm trucks.

Personal Property ExemptionBusinesses with $80,000 or more cost per county, with the same federal identification number, will file the required Business Tangible Personal Property returns postmarked by May 15th to avoid penalties.

Businesses with less than $80,000 cost per county, with the same federal identification number will declare the exemption by filing the required forms and marking the checkbox at the top of the Form 102, Form 103-Long, or Form 103-Short indicating the cost of your assets is less than $80,000.

Not for Profit Organizations that have filed a Form 136 Exemption and have been approved by the PTABOA, will file the required business personal property returns as usual. They will not claim the under $80,000 cost exemption.

For further personal property guidance, please refer to the Department of Local Government Finance (DLGF).

Click here for 50 IAC 4.2 Personal Property Regulation or Indiana Code 6-1.1-3.

For more information, please call the Assessor’s office at 812-379-1505 or e-mail . |

Exemptions

Tax DeductionsThe owner of the property who wishes to file for deductions can contact the Bartholomew County Auditor's Office at 812-379-1510 for more information. Below is a list of related forms for deductions:

Tax ExemptionsThe owner of the property who wishes to obtain an exemption must file State Form 9284 / Form 136 with the County Assessor. The owner must provide all information requested on the application and accompanying information sheet. There is no filing fee. Exemptions involve a certain type of property, or the property of a certain kind of taxpayer, which is not taxable. Application for exemption must be filed before April 1 of the assessment year with the county assessor. The application must be refiled every even year unless: (1) the exempt property is owned, occupied and used for educational, literary, scientific, religious or charitable purposes; (2) the property continues to meet the requirements of IC 6-1.1-10-16 or IC 6-1.1-10-21; and (3) an application was properly filed at least once in accordance with these statutes.

|

Sales Disclosure

New 2021 Sales Disclosure FormEffective January 1, 2021 the state of Indiana is using a new Sales Disclosure Form. These revisions were made to improve the filing process and to better identify property types. Forms can be submitted personally to our office or completed digitally. The new form, instructions for filing, and other related forms are found in the links below.

Sales Disclosure Form Instructions

|

Appeal Process

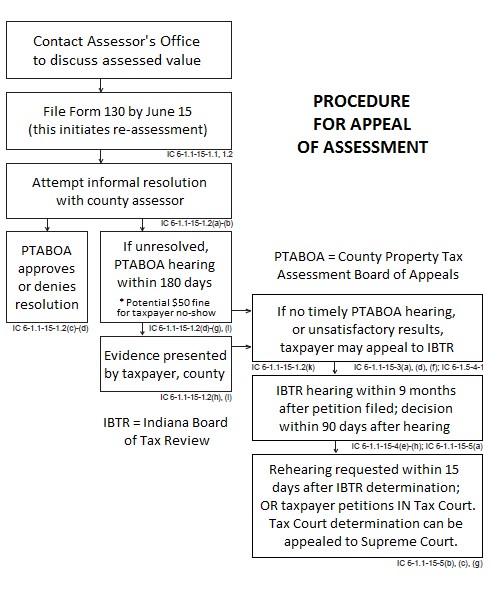

Should I appeal my assessment?Accurate property assessments are a priority for our office. The main question is, "Could I sell my property on the market for the assessed value?" A realtor could be contacted to help develop an idea of the value of your property. It is also important to verify the information being used to develop the assessment which is listed on the property record card. If you believe your property has been inaccurately assessed, please contact us. Most issues are resolved with a simple phone call or a scheduled office visit. If we are unable to come to an agreement, the state of Indiana offers all taxpayers appropriate recourse by law.

At right is an overview of the appeal process. Below are links to the form for filing an appeal and a good deal of information from the state about the appeal process.

|

|

About Us

|

Mission StatementTo be innovative in developing accurate, equitable and fair property values using assessment best practices with personalized and courteous customer service. The Assessor is an elected position and serves a four (4) year term. This official must complete Level III assessment certification, live in the county for one year prior to the election, and own real property located in the county upon taking office per IC 3-8-1-23. The primary duties of the Assessor are to certify the assessed values to the Auditor IC 6-1.1-4-24, serve as the secretary of the county property tax board of appeals IC 6-1.1-28-1, and equalize assessments. The full list of specific duties of the Assessor are defined in IC 36-2-15. Ginny Whipple has over 35 years of experience in the private appraisal industry, is an Assessment Administration Specialist certified by the International Association of Assessing Officials (IAAO), and is a certified Level III Appraiser for the State of Indiana. She brings the same level of professionalism in her service to Bartholomew County which she maintained throughout her career. As a member of the IAAO, certified IAAO specialty instructor, and state-certified instructor, she draws upon a broad network of resources to ensure Bartholomew County is a state leader in determining accurate and equitable assessment of property. |

|

|

Field Appraisal Team DescriptionEach residential field appraiser wears an ID badge and drives a county vehicle with the county seal (at right) on the doors. If a taxpayer is uncertain about the identity of a representative, please contact the Bartholomew County Assessor's Office at 812-379-1505 for verification. Our field appraisers will attempt to make contact with taxpayers, identify themselves, and explain the purpose for their visit. They will sometimes have to ask several questions to verify information about the interior of the property and request permission to inspect the exterior. If no one is home, personnel will proceed with their work, which includes an inspection of the front and rear of the property. Photographs may also be taken during inspection. When the inspection is complete, a door hanger may be left requesting the taxpayer contact our office to provide additional information. |

|

|

|

|

What People Are Saying About Us

Download Sales Disclosure Form

Download Sales Disclosure Form